Why Deflationary Spirals Are Kind Of Idiotic To Worry About

Leave a commentJuly 20, 2016 by Liberty

For those lucky uninitiated: What is a deflationary spiral anyway?

Inflation is the first thing to understand.

Any well-trained libertarian should already be familiar with inflation. Inflation is the increase in money supply and the corresponding decrease in the value of that money. In other words, if you double the supply of money you’re going to halve the value of that money. (Yes. Growth in production makes a difference but, lets not be silly folks, duh.)

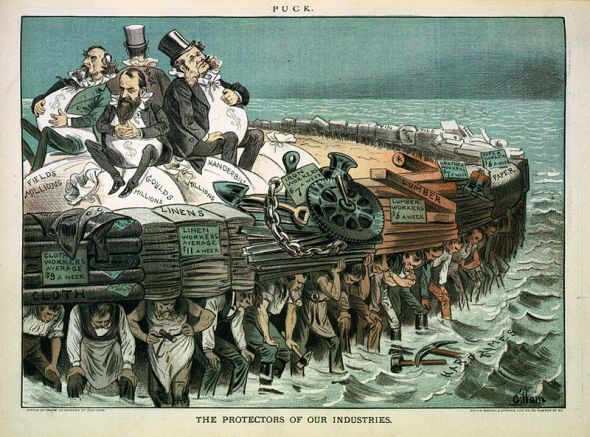

Deflation is inflation’s strange counterpart. While we’ve had the pleasure of watching the value of our money melt between our fingers, during the scary old robber baron days, folks actually had the value of their money increase.

In other words, the world works in the way that makes sense.

People got better at making stuff and their was a competitive market for that stuff. That stuff got cheaper. Less money could buy more stuff. You know, the progress of humanity and everything?

These days economists have become ever so comfortable with manipulating interest rates (printing money) that it’s virtually idiotic to keep more than the minimum in a traditional savings account. The money is worth less everyday.

As a good economists should think: you might as well spend it on strippers and alcohol. Capital for investment? Fooey… grow a pair of brain cells. You’ll be dead soon. Why worry about the future?

The real thing to worry about is…. DEFLATION!

Deflation, according to certain branches of economi…political ideologies, will almost inevitably lead to a deflationary spiral driving everyone into unemployment and to the brinks of starvation as their skin sinks below their ribs. The horrors of not having an obese population… my god I can’t even bear to think on it.

Why Deflation Is The Devil

-

Lowers Demand

When money increases in value, people buy less stuff because they know stuff will be cheaper later. When prices on products lower, it gives producers less incentive to create the product. That leads to them producing less of the product. That leads to them laying off employees. That leads to the employees buying less products. That leads to lowered demand. That leads to less incentives to create… This spiral will most inevitably lead to the horrible painful death of society as we know it, right?

But wait…

Can’t people invest their money in index funds and make similar percentage returns on their money right now? People have the choice between investing in the stock market and pulling in 8% a year or buying stuff. Currently, they buy stuff.

They can wait a year and almost certainly pay 8% less on a television. In that time they can invest in the market and make another 8% on that money. But… they still buy stuff.

Here’s a basic idea that can prove your idea is probably stupid…

If your idea requires the average person not be a short sighted buttmuffin then it’s probably not a very practical idea.

I mean… what the hell are you thinking? Oh no… people can make 4% a year off lowering prices! They’re not going to spend money anymore!

Sure… it makes sense that there would be a small decrease in the demand for certain things but people aren’t saving their money to never purchase anything. Maybe they’ll float more of their money into investments. Maybe they’ll buy more of the stuff they care about later. Maybe they’ll retire and waste away that money slowly. The money will get spent bro.

Lets assume this delay in spending creates a notable glut in the market (and assume that people aren’t too short sighted and idiotic to take advantage of reduced prices. Which is a hard case to make considering a handful of economists actually think about this like it’s a reasonable possibility. If a handful of well-trained economists have such weak intellects, how bad must the general population be…)

What happens? Do people continue to reduce their demand until they starve to death?

No… because filling their stomachs is more important than any monetary value. There is a base minimum spending that won’t stop taking place. People will still buy places to live. People will still put food in their stomach. They will still make medical purchases. And it’s completely idiotic to think it would spiral to the point where people put savings above the value of their own life.

Now compare that to inflation… When will we stop robbing old people of the money they’ve spent their whole life saving? When they’re dead!

-

No Central Bank Control

Central banks lose power during times of inflation. They can’t manipulate the interest rates because everyone is already getting a return on their investment in the money.

Consider this a philosophical difference but to me that sounds like a good thing.

“Oh no! We can’t manipulate the money supply and cause boom and bust cycles!”

GOOD!

I know that won’t convince anyone but here’s my real question.

How the hell do you still think they have any notable control over the market anyway?

If they do have control then why do they allow market crashes?

I guarantee half the answers to this are essentially religious arguments that are about as valid as saying “god causes war because he loves us and works in mysterious ways.” The more logical half of answers will be something like:

“They Don’t Have COMPLETE Control. It’s complicated.”

If it’s too complicated to control then they don’t have control!

The markets may self-correct for the government’s idiocy but we can’t predict how it’s going to self-correct.

-

The Forever Increasing Mortgage (And Sticky Wages And Other Duhs)

But…. if we had deflation then people wouldn’t be able to afford their mortgage.

Now… this is actually pretty interesting. It’s stupid to worry about long term but it’s still amusing to think about.

If you take out a mortgage today for $100,000 then you want inflation to reduce the value of money (perhaps) because it reduces the amount of money you owe. A year after taking out the debt you want that debt to magically shrink by 2%.

But… what happens if deflation takes place?

That debt could go up by 2% every year because just as companies give raises to cope with inflation they could cut pay to cope with deflation.

Oh my god! This could lead to a mass inability for stupid people that didn’t properly plan for their future struggling to pay their mortgage. By all means, since government has been bs’ing these people so long it’s hard to blame them for this assumption of no deflation.

But.. why wouldn’t the market adjust?

Oh wait… it FUCKING would!

Today banks hold that risk. No… they don’t generously hold that loss of their money through inflation for the good of the customer. They charge the customer for it! The customer already pays more money.

Would people stop taking massive mortgages? Maybe. Would banks eat the deflation cost to get more customers? Maybe. Would someone with more than a couple walnuts clunking around in their skull be able to think creatively enough to account for this? Definitely. As long as they’re not dumb enough to think a deflationary spiral is a serious concern.

Deflation sucks for government. It doesn’t suck for you.

Worrying about deflation is like worrying about anything changing in the market. It may suck for a few people short term but in the long run it’s better for everyone.

Share this article. Or don’t. Or screw it, donate a bit to the bitcoin account in the sidebar and make me feel better about life. I might write more. I might not. I’m taking my writing schedule super casually. If I can’t write something rude, bitter, and biting then I will probably focus on profitable endeavors.